Daniel Barker

Paddock Liberal Democrats Learn more

State pensioners left £5,000 short of minimum living standard

by danielbarker on 10 September, 2024

Mattie Brignal

State pension payments will leave retirees over £5,000 short of meeting their basic needs – even after an expected pay rise in April, analysis shows.

A single pensioner living alone would need an income of £17,200 a year to achieve a “minimum” standard of living, according to a study by the Joseph Rowntree Foundation think tank.

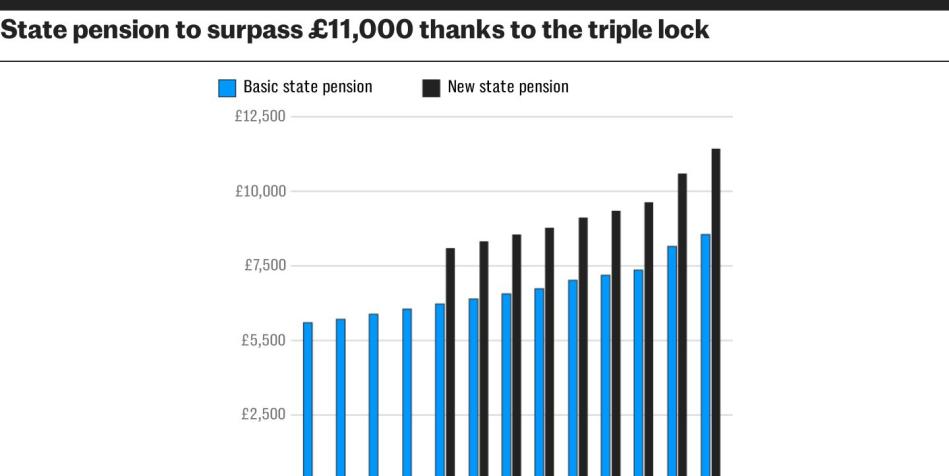

The “full” state pension is currently £11,502 a year for anyone who retired after 2016. The “triple lock” ensures that payments rise each year by the highest of inflation, wage growth or 2.5pc.

The pay bump for April 2025 will be announced on Tuesday. Leaked Treasury documents reportedly show that payments will increase by more than £400 next year for those on the full amount.

However, pensioners who rely solely on the state pension will still be left £5,200 short of meeting their basic needs even if the annual payment rises to £12,000.

To plug the gap between the current “full” state pension and the minimum income standard, a retiree would need a private pension of £78,600 by the time they reach state pension age of 66, according to separate analysis by financial services firm Just Group. This would be enough to buy an annuity guaranteeing £5,698 a year until they die.

It comes as Labour faces a Commons rebellion over its decision to strip 10 million pensioners of their winter fuel payments, worth up to £300 a year.

Around 20pc of pensioners have no income other than the state pension. Only around half of the 3.4 million pensioners receiving the post-2016 state pension get the full amount, while 150,000 are on less than £100 a week.

The “minimum income standard” is a figure calculated by the Joseph Rowntree Foundation to show how much money people need to “meet material needs like food, clothes and shelter without struggle”.

Pensioner couples would need £27,800 between them to meet the threshold, or just £13,600 each, as they are able to pool costs. This means they would still need around £1,600 of income on top of the state pension after the expected increase.

Stephen Lowe, of Just Group, said the “minimum income standard” reflected what pensioners were likely to need to “live in dignity” in retirement.

He added:

Even assuming pensioners are receiving the full state pension – which we know many are not – they will still need to find thousands of pounds a year of extra income to bridge the gap.

“It demonstrates the importance of building up additional sources of income throughout a working career, whether that is through the pension system, using property as a reservoir of wealth or accumulating additional savings and investments.”

The Treasury was approached for comment.

Leave a comment

Leave a Reply